SOL Price Prediction: Will SOL Hit $200 Amid Technical Consolidation and Institutional Support?

#SOL

- Technical indicators show SOL trading below key moving averages with bearish MACD momentum

- Record institutional inflows and $1B corporate buyback provide fundamental support

- Critical $150-$155 support zone must hold to prevent further declines toward $120

SOL Price Prediction

SOL Technical Analysis: Key Indicators Signal Consolidation Phase

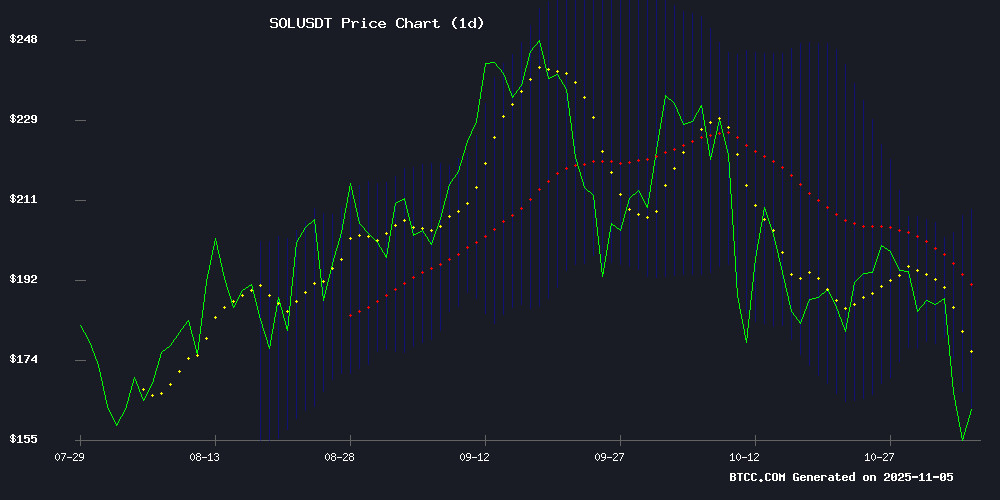

According to BTCC financial analyst Mia, SOL is currently trading at $159.52, significantly below its 20-day moving average of $185.25, indicating short-term bearish pressure. The MACD reading of -1.25 shows weakening momentum, while the Bollinger Band position between the middle ($185.25) and lower band ($161.76) suggests consolidation around current levels. The technical setup points toward continued range-bound trading unless decisive breaks occur above the moving average or below the lower Bollinger Band support.

Mixed Market Sentiment Amid Institutional Support and Price Pressure

BTCC financial analyst Mia notes that while institutional inflows have reached record highs, creating underlying support, SOL faces significant technical headwinds. The market sentiment reflects cautious optimism as the cryptocurrency battles to maintain the $150-$155 support zone. The $1 billion buyback program from Forward Industries provides fundamental strength, but technical breakdown risks remain if SOL fails to hold current levels, potentially targeting the $120 support mentioned in recent predictions.

Factors Influencing SOL's Price

Solana Price Prediction: Institutional Inflows Hit Record Highs as SOL Battles to Hold $150 Support

Solana's price action reflects a market torn between institutional confidence and technical vulnerability. Despite recording over $400 million in ETF inflows—a clear signal of institutional demand—SOL has broken its 211-day uptrend, a worrying sign for short-term traders. The coin now hovers at $157.05, down 5.19% in 24 hours, with critical support at $150 under threat.

A Tweezers Bottom pattern near $150 offers a glimmer of hope for bulls, suggesting potential reversal. Yet failure to reclaim this level could expose Solana to deeper corrections toward $138 or even $120. Market dynamics indicate smart money may be rotating rather than accumulating, echoing mid-cycle pullbacks seen in prior bull markets.

Forward Industries Launches $1B Buyback Program Fueled by Solana Treasury

Forward Industries has authorized a $1 billion share repurchase initiative funded entirely through its Solana-denominated treasury reserves. The move signals a strategic pivot toward leveraging blockchain-native assets for corporate finance operations.

Solana's liquidity and security features enabled this unconventional capital allocation. "This isn't just treasury management - it's a fundamental rethinking of how enterprises can utilize digital assets," noted a market analyst tracking the development.

The buyback program coincides with growing institutional adoption of Solana for DeFi applications and enterprise solutions. Forward Industries' treasury had previously allocated significant holdings to SOL during the network's technical upgrades earlier this year.

Solana Price Prediction: SOL Tests $155 Floor with $120 in Sight if Breakdown Confirms

Solana's price teeters at a critical juncture, with the $155.83 support level serving as the last bastion for bullish sentiment. A decisive close below this threshold could trigger a slide toward $140-$145, while holding firm may pave the way for a rebound to the mid-$170s. Technical indicators paint a mixed picture—the 50-day moving average shows signs of fatigue, while the 200-day MA has already been breached.

Market participants eye $122 as a potential accumulation zone should the correction deepen. The coming sessions will prove pivotal in determining whether SOL maintains its structural integrity or succumbs to broader market pressures. As one trader noted: 'This isn't just a technical test—it's a referendum on Solana's near-term trajectory.'

Will SOL Price Hit 200?

Based on current technical indicators and market sentiment, BTCC financial analyst Mia suggests that reaching $200 in the near term appears challenging. SOL would need to overcome significant resistance levels and demonstrate sustained bullish momentum. However, the record institutional inflows and corporate buyback programs provide fundamental support that could fuel a recovery toward higher targets over the medium to long term.

| Current Price | 20-Day MA | Key Resistance | Key Support |

|---|---|---|---|

| $159.52 | $185.25 | $208.73 | $150.00 |